At Books & Benchmarks, we believe in keeping financial processes simple. Our chart of accounts can roll a P&L up to just eight line items. We prefer to keep the number of bank accounts and credit cards to a minimum for simpler operations. We think having fewer people touch financial statements reduces errors and increases efficiency.

It’s not that we’re afraid of complexity; how we break out payroll is a technically demanding task and we’re committed to getting balance sheets right to tightly track cash flow.

However, for multi-site and multi-entity practices, a certain level of complexity is necessary to produce a meaningful understanding of the entire business.

Organizing Multi-site and Multi-type Practices

In accounting, it’s important to remember that each business entity has its own set of financial statements, anchored by a balance sheet. Entities exist for both tax reporting and legal (liability protection) reasons. So, a three-location private optometry practice could be set up as a single business entity, two entities (one with two locations and one with a single location), or three separate entities—one for each location.

We believe there are two cases where optometry practices should have separate entities:

- Practices where the owner(s) own the real estate. Real estate should be held in a separate LLC from the practice, with the practice paying rent to the real estate business.

- Generally, we think practices with both independent locations and subleased or franchised (not Vision Source) locations should keep those entity types separate. Talk with your CPA and/or attorney about what’s best for your situation.

In some cases, an OD who does a lot of public speaking or consulting might choose to have a separate consulting company. However, that income can often be classed (more on classing below) or booked below the (Operating Income) line in “Other Income” on the P&L.

There are other reasons you might want to use multiple entities to organize your practices. First, if some of your locations have different ownership structures, they’ll need to be separate entities for ease of administration.

Secondly, if you think you’ll transition locations independently (not selling the group all at once), your life will be easier from a valuation and transaction standpoint if those locations are each set up as their own entity. This could also be wise if you think you might have associates buy into individual locations over time (and not the entire group).

Accounting for Multi-site Practices

One advantage of setting up each location as its own entity is that each entity has its own set of financials, its own credentials, and its own obligations. Each location owns its unique set of assets, handles its own loans, generates revenue, and pays its vendors independently.

Accounting will be somewhat more expensive as you’ll be preparing multiple business tax returns, but it is cleaner.

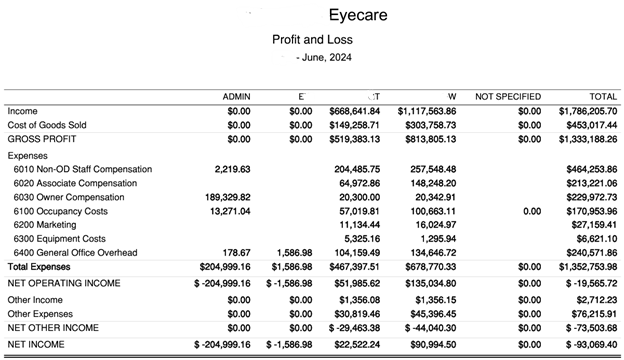

Another approach is to class revenues and expenses within a single set of financial statements. In this approach, each location gets its own column within a single P&L. There may also be a cost center that reflects the shared administrative cost of all locations. All classes will then be rolled up into a single P&L for the group in the far-right column. It might look something like this:

Strategies for Streamlining Multi-Office Financials

Whether you go with separate entities or class revenues and expenses within one, accept that some locations will bear more costs than others. Some third-party payers may be handled by only one location. Similarly, all vendor purchases might come to one location or account to maximize volume discounts.

Accurately spreading costs across multi-location practices will always be an inexact science. Some revenues and expenses will be crudely pro-rated across locations. Beyond that, here are some other ways to simplify accounting across multiple offices:

- Give each location its own bank account and credit card. As much as possible, have each office pay its expenses—and only its expenses—from its own accounts.

- Work with your payroll provider to set up your departments or locations so that it’s easy to account for employees’ hours and locations, especially if they work at several sites.

- Explore whether vendors can bill to one location but ship to several as a way to break out the costs each location bears.

- As always, keep personal expenses off the practice accounts, as it’s even worse to try and separate one more set of expenses from already-complicated practice charges.

Complexity Calls for Expertise

Getting a clear picture of your revenue, overhead, and profitability across multiple locations is hard, especially for owners and staff who are already spread thin trying to support all those locations. Even CPAs may prefer to roll everything into one P&L, just to get to a tax number.

If you want to free up time and enhance your understanding of your multi-site practice, talk to Books & Benchmarks about how we can take financial reporting off your plate and give you deep insights into how your practice is performing and what it needs for the future.