This week, a client asked me to review the financial statements for an optometry practice he was thinking about purchasing—an all–cash-pay, high-end optical boutique that averages nearly $1,000 per comprehensive exam. His gut feeling was that the practice’s profitability (EBITDA: earnings before interest, taxes, depreciation, and amortization) seemed low, making it a less appealing investment.

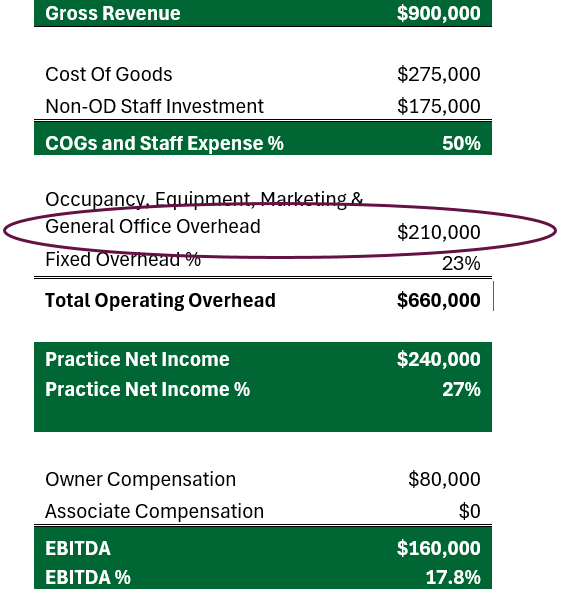

Here’s a rough breakdown of the key factors from the profit and loss statement (P&L):

I’ve circled the key metric that stood out compared to other practices. Of the $210,000 in fixed expenses, nearly $100,000 was attributed to occupancy costs alone.

This luxury practice was in a desirable, urban, major metro area. Rent alone ran nearly $50 per square foot, about twice the national average.

So, this is a high-end practice in a high-end neighborhood. How then shall we evaluate it as an acquisition opportunity?

The Value of an Asset Is the Future Expected Cash Flow

The interesting thing about this case study is that, as a turnkey acquisition, it isn’t ideal. This practice isn’t as profitable as you might expect, given its “unicorn” status as a high-retail, cash-only practice.

However, its variable costs, the cost of serving each additional patient, are below average. While the cost of goods sold (COGS) is slightly above 30% of collections (typical for a retail-driven practice), the non-OD staff costs that support patient flow come in at just under 20% of revenue, which is notably lean.

One of the advantages of a practice with high retail sales is lower labor costs.

Because each patient spends more than in a comparable practice, it takes fewer patients to achieve similar gross revenue. With fewer patients overall, the practice naturally requires fewer staff to manage the flow.

Fixed Overhead is a Doozy

But every rose has its thorn. A high-income, cash-paying patient base usually means the practice is in a more desirable area, and that comes with higher real estate costs.

In this case, rent runs $50 per square foot ($90,000 ÷ 1,800 sq. ft.), which works out to $7,500 per month just to secure the space.

This is a blessing and a curse. It’s a curse because accessing these patients costs $7,500 per month. It’s a blessing because it only takes 1,000 paying patients to reach the practice’s current P&L (1,000 comprehensive exams x $900 per exam = $900,000 in collected revenue).

The most striking fact about this practice is that it only takes 21 comprehensive exams per week to reach its annual collected revenue:

- 10.5 comprehensive exams per day

- 2 patient care days per week

- 48 weeks per year

And yet, despite the appeal of its high-income patient base, there still aren’t enough patients to fully offset the high costs of operating in such a desirable neighborhood.

Grow the Revenue, Fix the Profits

Early in my career, a practice owner asked me what the break-even point would be for an office in a retail center anchored by an Apple Store, staffed entirely by employed ODs.

Short answer: the practice would lose money until it reached at least $800,000 in collected gross revenue.

“No problem,” the owner said. “This will be a $2 million practice once it hits its stride.”

She was right.

Which brings us back to our case study. My advice to the prospective buyer wasn’t, “This practice isn’t attractive because its profits are below average.”

I said, “If you can get this practice to 40 patients per week at $700 per comprehensive exam, it will grow from $900k to over $1.3MM, and profitability will take care of itself.”

And it would, because that high rent rate isn’t tied to patient volume. At $90,000 per year, rent is 10% of the current revenue. But at $1.3M, it drops to just 7.4%. With fixed expenses like this, revenue growth almost automatically drives profit growth.

Simple Numbers Map a Clear Path

For many practice owners, financial statements are just a way to see how much they earned and to help their CPA file taxes. They rarely provide insight into how the practice is really performing or what steps to take next.

If you want financial statements that guide your decisions and show you the path to growth, reach out to our team at Books & Benchmarks. Our approach to financial reporting helps practice owners make smarter, more informed choices for their business.