Cash management is a lot like the story of Goldilocks and the Three Bears. If you keep too little cash on hand, you’ll have some “exciting” weeks when both the payroll and distributor bills are due. But if you keep too much, you miss out on the opportunity to use the cash you didn’t need to cover ordinary expenses.

In my experience, most optometry practice owners keep too much cash in their practices. There are three main reasons owners should regularly take excess cash out of the practice:

- If your practice is a pass-through entity like an S-corp, LLC, or sole proprietorship, your taxes are based on profits, not cash flow. In many cases, your excess cash has already been taxed, so there’s no tax benefit to leaving it in the practice.

- If inflation is higher than the interest rate on your checking and savings accounts, any extra cash loses its purchasing power. Even if interest rates are favorable, there is still an opportunity cost of not putting that cash into more productive investments.

- In the unlikely event you’re sued, money in the practice is at risk. For most practices, your corporate form will shield funds you’ve taken out of your practice.

How much cash should you keep in your optometry practice?

Now that you understand the importance of getting cash out of your practice, how much should you keep? Below are two formulas to consider. I think both are conservative, but I’ve noticed that optometrists tend to be more conservative than me. For both calculations, let’s use this practice’s 6-month financials:

| Gross Revenue | $750,000 |

| Cost Of Goods Sold (COGs) | $250,000 |

| Non-OD Staff Investment | $125,000 |

| COGS and Staff Expense % | 50% |

| Occupancy, Equipment, Marketing & General Office Overhead | $150,000 |

| Total Operating Overhead | $525,000 |

| Practice Net Income | $225,000 |

| Practice Net Income % | 30% |

| Owner Compensation | $50,000 |

| Associate Compensation | $75,000 |

| EBITDA | $100,000 |

1. More Aggressive Formula

For a conservative approach that still prioritizes getting money out of your practice, you should set aside one month’s expected expenses (excluding the owner’s pay) based on the last 6 months. The owner’s salary plus the profits is $150,000 ($50,000 compensation plus $100,000 in profits). That means all the other expenses of the practice are $600,000 ($750,000 in revenue minus $150,000 in owner pay and profits). The average monthly expense is $100,000 ($600,000 ÷ 6 months), which is the cash reserve target.

2. An Even More Conservative Approach

For a bullet-proof, you’ll never run out of cash even-if-COVID-happens-again formula, use two months’ expected expenses (excluding the Cost of Goods Sold but including the owner’s salary). Based on the previous profit & loss statement, the 6-month expenses are $400,000 ($750,000 Revenue – $250,000 COGS – $100,000 EBITDA = $400,000).

Divide this by six months and you get $66,667 in monthly expenses, meaning two months’ expected expenses is $133,333. This formula will typically leave 30%-50% more in cash reserves than the other formula.

What To Do With Your Reserve Target

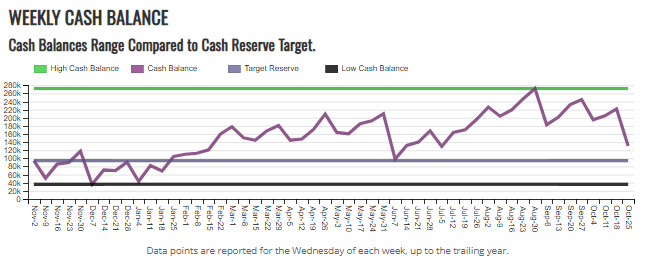

Having a target is great, but you may have noticed that your checking account(s) balance doesn’t just stay put. It probably looks like this (possibly my favorite chart in Books & Benchmarks):

Given that it moves so much, what is a practice to do? Pick a regular interval—I prefer quarterly but semi-annually works too—to look at your cash on hand. And then you have a choice. If your balance is higher than your reserve target, distribute the difference (like our example practice did on June 7 in the chart above).

If you’re below your target, skip the distribution and let your cash position build back up. Also, make sure you’re communicating with your CPA about your distribution strategy. There can be tax consequences depending on your practice’s legal structure or financial history.

If cash is only going down, that’s a different article. But it’s definitely something that needs addressing.

Where to be Conservative

Many optometrists tell me the only reason they sleep at night is because of the excess $300,000 they have in their practice account. And I do have an answer for this:

- Be super-conservative with your personal finances.

- Be aggressive in getting cash out of your practice. If it helps you sleep, have a huge cash emergency fund for your personal finances.

You can always put money back into your practice if things get too tight. Or you can use a line of credit to float things for a couple of days between “distributor bill and payroll fall on same day” and “next big insurance reimbursement clears.”

Excess cash in the practice often sits in an account losing value to inflation or tempts you to make imprudent equipment purchases. Keeping only the cash you need in your practice helps you make more disciplined investment decisions and encourages you to diversify your wealth.

Books & Benchmarks combines professional bookkeeping services with automated benchmarking reports to help you make smart business decisions. If you need help sorting out your finances or deciding on the right amount of cash to keep on hand, give us a call today to learn about our services.