One of the scariest and most important risks practice owners face is taking on fixed expenses ahead of growth. The best way to think about fixed expenses is that they are the bills you pay regardless of how many patients you see or how much revenue comes into your practice.

And the biggest fixed expense for nearly every practice is the cost of space, whether rented or owned. While occupancy costs include other expenses like utilities, common area maintenance (CAM), insurance, taxes, and maintenance costs, rent is the bulk of this category.

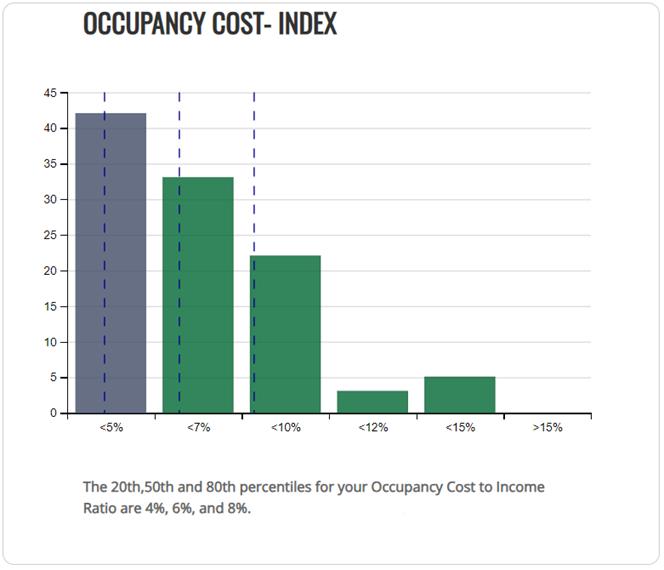

The middle 60% of Books & Benchmarks practices spend between 4% and 8% of revenues on occupancy costs, with a median of 6% of revenues. Here’s the distribution of our practices:

Opportunities and goals are paramount

When evaluating expenses like occupancy costs, it is critical to maintain a balance between growth and profitability. As practices get busier, profitability increases if revenue grows faster than the (usually small) rent increases year over year. Which, put simply, is a good thing.

But eventually, growth will be constrained because a practice’s space can’t support more patient volume. However, if you think this means all practices should expect to increase their footprints repeatedly so long as the owner aspires to grow, I’ll remind you of every consultant’s favorite answer: “It depends.”

Some practices don’t have the patient base to grow into perpetuity. If a practice already owns its local market and there aren’t more patients to be seen, the best course is to maximize its space productivity and profitability. These practices should only reinvest as necessary to maintain revenue and profits.

For the remaining practices, the major question is: “How much can I afford to spend on new space?” Increasing expenses is always a risk. But keep in mind that (anecdotally) we typically see growth rates of 20% to 25% in the first year or two of a move (or a remodel).

Whether it’s because of an increase in patients, a higher revenue per exam due to a more premium space, or staff enthusiasm, those are the typical results. And because of that, we’re comfortable with practices spending 10%–12% of current revenues in the first year in a new space.

What if you own your space?

All things being equal, it is better to own than rent. Practices that own their space often find it easier to renovate or modernize it because they aren’t spending money on “someone else’s building.” And as you pay down the principle on an owned office space, you’re building your equity in that asset.

Pro Tip: Owned real estate should be held in a separate LLC (NOT an S-Corp or your practice’s entity) that charges rent to your practice.

But many owners struggle with what rent to charge themselves. On the one hand, there are often tax advantages to charging more rent to the practice, lowering your net income and therefore your tax bill. On the other hand, charging a higher rent will impact the net income your P&L shows (even though you’re paying that rent to yourself).

If you’re struggling with how to handle paying rent to yourself, your CPA can guide you on tax implications, a Certified Financial Planner (CFP) can assist with wealth-building strategies, and a commercial real estate broker can provide insight on “fair market” rent for your space.

What about business valuation?

For owned space, this is where a CFP becomes an important advisor. If you charge above-market rent for tax-planning purposes, it will lower your net income and your valuation.

But since real estate tends not to sell at the same time as the practice, you may end up renting the space to your buyer for years after you sell. Sometimes, it is better to keep the option of charging higher rent rather than maximizing the value of your practice.

Whether you charge fair market or above-market rent to yourself, charging zero rent to the practice will complicate your practice valuation AND renting the space to a potential buyer. Even after you pay off your building mortgage, pay yourself rent. Whatever you want to charge a future buyer, negotiating will be much easier if you first pay yourself the rent you expect from them.

Clear financials, every step of the way.

If you want to make sure your practice looks “relatively” normal compared to your peers, consider joining Books & Benchmarks. We combine accurate and meaningful financial reporting with the most robust automated benchmarks for optometry practices. Schedule a call with us to learn how you can gain a complete picture of your financials and how they compare to other practices in the industry.