Profitability is kind of a big deal. It can also be hard to define, as anyone who follows optometric Facebook groups has seen. Let’s talk about how Books & Benchmarks helps owners understand their own practice’s profitability.

Definitions of Profit

Simply put, profit is the money left after a business brings in revenue and pays its expenses. It’s also known as the bottom line. But if you take a look at your Profit & Loss Statement (also called an Income Statement or P&L for short), you’ll notice three lines with “Profit” or “Income” in their names.

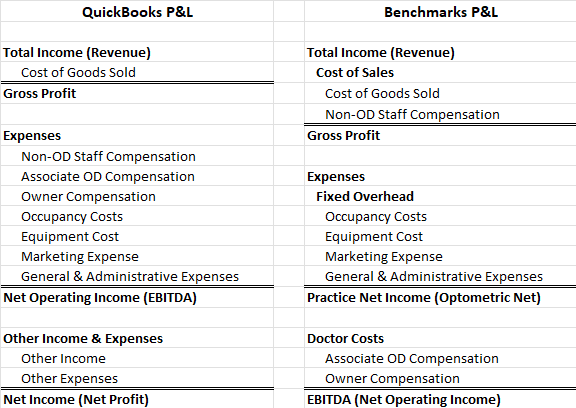

Each measure of profit tells you something different. In fact, we have different financial layouts for our clients’ QuickBooks files and the Financial Benchmark Report in our member portal. Let’s compare them side-by-side to see how they differ:

Starting with the QuickBooks P&L, let’s work our way up from the bottom to see how different measures of profit help decision-makers in different ways.

Net Income

This is what we call the bottom line, which is what’s left after covering all business expenses. With some adjustments, it’s basically the taxable income generated by the practice.

Right above Net Income, there’s a section called “Other Income & Expenses.” This section includes things like:

- Non-cash tax deductions like Depreciation and Amortization

- Interest (the cost of borrowing money)

- Unusual or one-off sources of income like PPP forgiveness, EHR incentives (back in the day), outside speaking fees, payment for work outside the practice, and perhaps the sale of an asset. These are income sources that aren’t your typical earnings from running an eye care practice.

- One-off or unusual expenses.

Net income is the bottom line, but because of the “Other Income & Expenses,” it’s not always the best indicator of business performance.

Net Operating Income

Net operating income is a better indicator of business performance because it leaves out non-cash deductions and one-off income or expenses. If you’ve heard the acronym EBITDA thrown around, our net operating income line IS an EBITDA calculation (more to come on EBITDA).

In optometry, if a practice doesn’t have a positive net operating income, it’s almost certainly losing cash (even if the negative result includes the owner’s wages). However, a positive net operating income (or net income) doesn’t necessarily mean the cash in the practice’s checking account is increasing.

Remember, net operating income doesn’t include interest payments. And while the Net Income at the bottom does reflect interest, those interest payments are coupled with principal payments, which only show up on the Balance Sheet and Statement of Cash Flows.

Even so, if your net operating income is low, chances are you’re having cash flow issues. On the other hand, if it’s strong, you’d have to have a LOT of debt to really be struggling as an owner. Next week, we’ll make a lateral move (visually, diagonal, down, and to the right) from the Net Operating Income line on the QuickBooks P&L to the EBITDA line on the Benchmarks P&L, where we’ll learn that even the most normalized benchmarks still have to be read with care.

If your head is spinning from all the financial terminology or you’re finding it difficult to measure your profitability, reach out to our team of experts at Books & Benchmarks. We’re here to provide personalized guidance and financial reports that cater specifically to optometry.