Staffing is one of the hardest and most critical aspects of building a great optometry practice. The challenges to getting it right are myriad: recruiting, firing, managing, vision-casting, training, and more go into building and maintaining a great team.

I mention this because if higher pay alone guaranteed a better staff, many practices would gladly invest in it. But right now, many practices are dealing with wage inflation without seeing any improvement. Costs are going up, but their team isn’t changing.

Last week, I spoke with several practices whose staff costs were well below average. I think we all recognize that high labor costs are difficult to unwind and a real headwind to profitability. But what about the other side of the equation? What challenges come with lower expenses and what opportunities might they create?

Start With Normal

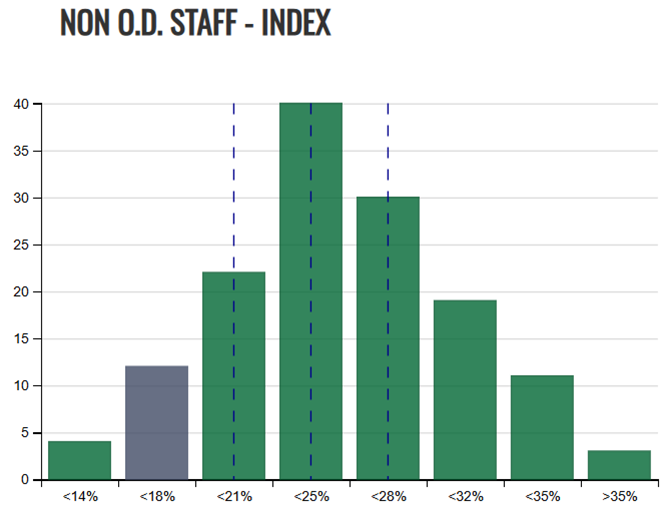

Before we talk about “low” or “below average” payroll, it’s worth defining “normal.” At Books & Benchmarks, we measure expenses as a percentage of collected gross revenue. Here’s an example of a practice on the low end of the distribution of non-OD staff costs among our clients:

The dashed lines represent the 20th, 50th, and 80th percentiles of the distribution—21%, 25%, and 28% in 2024. While we don’t like to tell practices what they should do, it’s fair to say that the middle 60%—falling between 21% and 28% of revenues—represents a typical range.

Now, what does it mean if a practice’s non-OD payroll percentage falls below that “normal” range?

It Might Be a Problem

I once saw a benchmark chart that treated any “below normal” expense area as a “green light.” But I’m not so sure that’s always the case. If you’re spending less than average, it could be because:

1. You’re understaffed.

This is different than being super-efficient with your staff. An understaffed practice cannot sustainably deliver great service and manage its operations. Some typical consequences of being understaffed include:

- Chaos anytime a team member is out.

- Low eyewear and/or contact lens capture rate.

- Low collections or high aging on receivables.

In these cases, adding staff and payroll expenses often leads to higher revenue (or cash flow) growth than the cost of the new employee. For some practices, it’s worth trading slightly lower profitability for more stability and breathing room in daily operations.

2. You’re underpaying your team.

It’s also possible that your wages are below market rate—at least in your local area since pay varies widely across the country. If you regularly lose employees to higher-paying jobs, it may be time to research prevailing wages in your area. If you’ve fallen behind, you can quickly buy back some goodwill by making one-time adjustments to bring individuals’ wages in line with norms.

It Might Be an Opportunity

On the other hand, a below-average non-OD payroll could simply mean the wages for various roles in your local market are lower than national norms. In this case, instead of facing a possible issue for your practice, you have an opportunity:

- Staff up. With lower wages in your area, you might have the flexibility to hire beyond what a “typical” practice would. More team members can enhance the patient experience, make doctors’ lives simpler, or make it easier for your practice to absorb staff absences.

- Pay up. Another option is to invest in your existing team by offering above-market wages or using higher pay to attract top talent. In some markets, better talent may be hard to find, but paying generously can help reduce turnover and create a more stable team.

- Take the profit. Finally, if your payroll is truly efficient, you don’t have to change anything. If you know your staff is well-compensated and your patients are well-served, maybe the next thing to do is…nothing. There’s nothing wrong with taking the extra profit and using it to build long-term financial security.

Full Perspective Leads to Better Decisions

What we’ve just discussed can only be considered after a practice knows how they compare to industry norms. It’s that perspective that raises the right questions.

And that’s what we do at Books & Benchmarks. We don’t just provide accurate, reconciled financials. By incorporating meaningful optometry practice benchmarks, we give owners actionable insights into the uniqueness of their own practice. Contact our team today to learn how we can help your practice thrive!