Wages, when doctors and staff are taken together, are almost always the largest expense for private practices’ P&Ls. For many, the non-OD staff salaries alone are higher than any other expenses. Let’s dig into that number—non-OD Staff Compensation—to better understand what it includes and what practices spend.

Define, then measure

Many practices’ P&Ls fail to show owners and managers their true spending on payroll because they lump together all wages, all payroll taxes, and all benefits. Sometimes wages are broken out between owners and employees or, ideally, between owner ODs, associate ODs, and non-OD staff, but taxes and benefits are still grouped together.

You’re probably guessing now that the best way to handle payroll management for optometrists is to separate wages, payroll taxes, and benefits (retirement, health insurance, etc.) for owners, associate ODs, and non-OD staff. However, splitting these and grossing them up can be technically challenging (learn more in our blog on breaking out payroll), and I’m especially proud of how our bookkeeping team handles this every month.

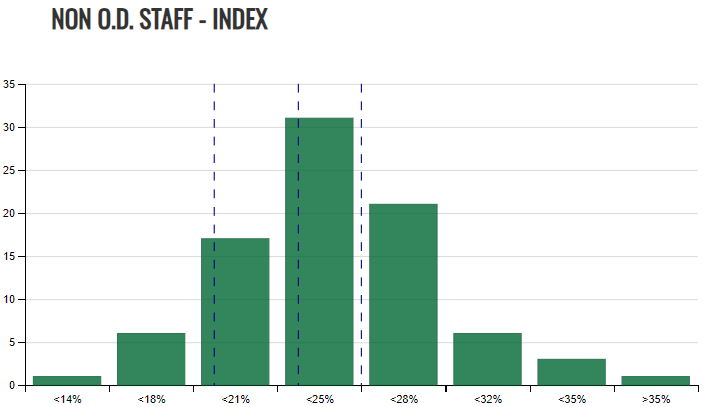

In 2023, the median Books & Benchmarks client spent 24% of revenues on Non-OD Staff Compensation. The 20th percentile was 20% and the 80th was 27%. Two quick notes on the distribution:

- The middle 60% (20th to 80th percentile) is tight, but it is 4% higher than older benchmark reports would suggest.

- As with Cost of Goods Sold, notice the broad range between under 14% of revenue to over 35% of revenue (eek)!

Responsibly responding to reality

Of all the areas where inflation has impacted practices, wage inflation has perhaps been one of the most painful and difficult to navigate over the past three years. It’s been a jolting change for owners to fearfully feel the need to offer raise after raise to retain their current team and then take on ever-higher starting wages for new employees.

We often talk about how there aren’t many expenses a practice can just cut. Payroll is a prime example. If you’re looking for cost savings in your payroll, we dare you to cut some team members’ hourly rates. (Let us know how it goes).

So, what can you do to proactively manage labor costs? Here are a few thoughts:

- Do your homework and know the average wage for the various roles on your team. That way you won’t be caught off guard when employees ask about raises. You can even be the hero by proactively increasing wages if you’ve fallen behind.

- Consider whether paying above-market wages for higher-caliber team members can let you get away with having fewer employees overall. If paying 25% more for a biller saves you having to hire a second, that’s a great trade.

- Consider areas where you can outsource (even offshore) certain roles that don’t need to be physically in your office. Anecdotally, we are consistently hearing that when done right, offshore receptionists and scribes are wonderfully professional and reliable and at considerably lower hourly rates.

Start high-level, then dig deeper

We’re very proud of how Books & Benchmarks is helping practices get an accurate picture of their labor costs, overall expenses, and profitability. (Read part 1 of our blog series on understanding profitability benchmarks to learn more!) But we’re especially excited about the new productivity benchmarks we’re rolling out this year.

Take this week’s metric, Non-OD Staff Compensation. Whether it’s higher or lower than average, you need to ask two questions to understand why:

- Does your practice have more or less headcount than other practices?

- Are your average Non-OD Staff Wages higher or lower than other practices?

This year we’re adding Full Time Equivalent (FTE) counts of all staff (owners, associate ODs, and non-OD staff) and integrating patient volumes from IDOC Insider. These new metrics will allow us to report Revenue per Non-OD Staff FTE, Exams Seen per Non-OD Staff FTE, and Average Compensation per Non-OD Staff FTE.

If you want to automatically have access to these valuable insights for your practice, contact us today to learn more about plugging into our growing and robust platform for business intelligence.