“Where am I spending too much money?” is one of the most common questions I hear from ODs. And it makes sense: a fast way to increase profits and cash flow is to stop spending money.

However, most optometrists tend to be conservative with spending, so it’s uncommon to see practices consistently overspending on day-to-day expenses. That said, frame buying can sometimes exceed what’s practical, and many practices are currently feeling the pressure of wage inflation.

Still, if you’re trying to identify elective expenses, General & Administrative (G&A) Expenses, also called General Office Overhead, is usually the best place to start.

What Goes Into G&A?

If you think about the 7 Key Expense Areas (Cost of Goods Sold, Non-OD Staff Costs, OD Staff Costs, Occupancy Costs, Equipment Costs, Marketing, and G&A), any ordinary expense that doesn’t fall neatly into the first six typically ends up in G&A. Meanwhile, interest, taxes, depreciation, and amortization are categorized under Other Income & Expenses.

In Books & Benchmarks’ chart of accounts, G&A is a broad-ranging category that encompasses everything from toilet paper, insurance, software licenses, and meals to travel, professional fees, dues, and subscriptions.

What do Practices Spend on G&A?

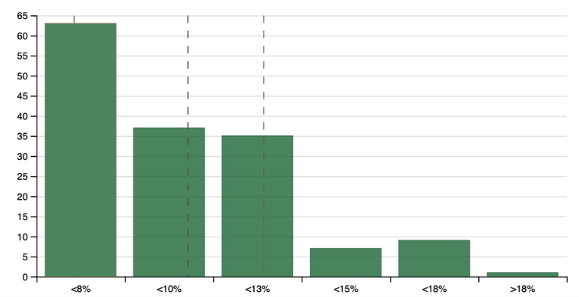

Here’s how Books & Benchmarks practices allocated their G&A spending in 2024:

The middle 60% of practices spend between 7% and 12% of gross collected revenue. Remember, administrative expenses are generally fixed expenses. As revenue grows, G&A as a percentage of revenue declines.

Managing G&A

I recommend that practices take a quick look at their G&A expenses once or twice a year for two key reasons:

1. Watch for Miscategorized Expenses in G&A

First, items in G&A are sometimes miscategorized. For instance:

- Professional fees that should be listed as contract labor under Non-OD Staff, such as outside billing services or virtual assistants.

- Office supplies or travel expenses that are really personal. Also, be thoughtful about what counts as your “uniform.” Items like sneakers usually don’t and should be categorized as distributions.

2. Identify Opportunities to Cut Spending

Secondly, sometimes an item will pop up and you’ll ask, “Do I really need to be spending that much on that?” Common examples would be:

- Professional fees. Tax preparation (CPAs) and IT services can be surprisingly high. As a general rule, if you are spending more than $15,000 annually on these, it may be time to switch providers unless you have a very large practice.

- Office supplies, especially if staff are ordering them.

- Credit card processing fees are worth revisiting from time to time.

Benchmarks Help Identify Abnormalities

The best way to catch irregularities is to know what “normal” looks like. That’s why we don’t just reconcile our clients’ financial statements so the net income is ready for tax prep. We use a chart of accounts specifically designed for independent optometry practices, so owners can clearly understand their overhead and profitability.

We then create automatic reports showing our clients how their overhead and profitability compare to the broader group of our clients. That way, they can quickly identify areas where they might benefit from increasing their investments or where they may have opportunities to trim costs.

Do you want to gain clearer insight into your practice’s financial health? Contact the Books & Benchmarks team today to learn how we can help you take control of your numbers and make smarter business decisions.